Best Ideas For Picking RSI Divergence Trading

Wiki Article

Recommended Ideas For Choosing An RSI Divergence Strategy

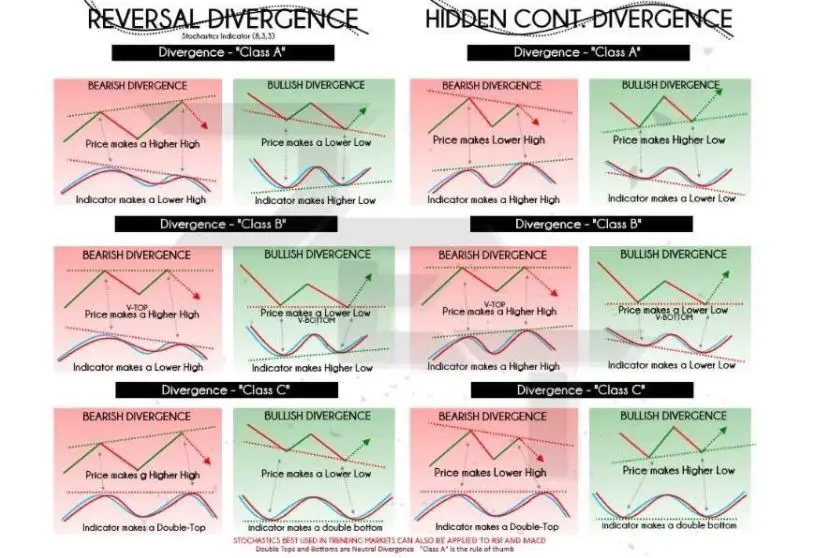

Let's start with the most obvious question. Let's examine the what RSI Divergence looks like and what information about trading can be learned from it. When the price action of your chart and the RSI signal are out of sync, a Divergence will occur. In the market that is trending down, Price makes a Lower low, but the RSI indicator is able to make higher lows. A divergence is essentially when the indicator does not agree with the price action and, when a situation such as occurs, it is important to pay attention to the market. According to the chart, both bearish RSI divigence (bullish) and bearish RSI divigence (bearish) are obvious. However, the price action actually changed in the wake of both RSI Divergence signals. Let's get to one last topic before move to the thrilling topic. Take a look at top rated trading platform cryptocurrency for more tips including trading platform, automated cryptocurrency trading, RSI divergence, trading platform crypto, forex trading, forex backtesting software, crypto trading, backtesting strategies, best crypto trading platform, software for automated trading and more.

How Can You Determine The Divergence In Rsi?

We use RSI to detect trend reversals. It is vital to determine the right one.

How Do You Detect Rsi Divergence When Trading Forex

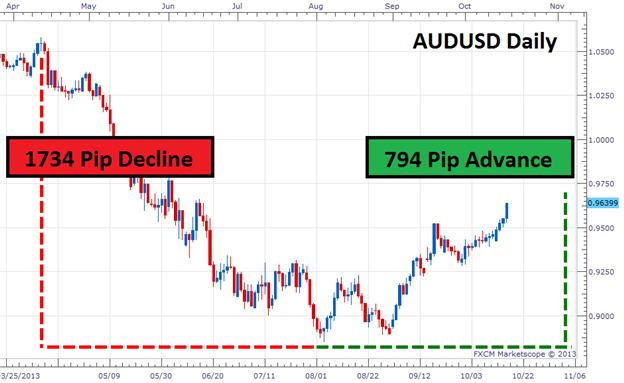

Both Price Action (RSI indicator) and Price Action (Price Action) performed the same thing in the beginning of the trend by making higher highs. This suggests that the uptrend may be strong. But at the conclusion of the trend, Price forms higher highs but the RSI indicator formed lower highs which indicate something to be watched in this chart. This is the time to be aware of the market because the indicator and the price action are out of sync which implies that there is an RSI divergence, isn't it? In this instance, the RSI Divergence indicates a trend that is a bearish. Check out the graph to observe what transpired after the RSI Divergence. The RSI divergence is extremely precise in identifying trend reverses. However, the issue is: How to actually catch the trend reversal, right? Let's now talk about four trade entry strategies which provide higher probability entry signals when combined with RSI divergence. Have a look at the top rated forex tester for blog examples including cryptocurrency trading bot, crypto trading, divergence trading forex, automated trading bot, RSI divergence, trading platform crypto, forex trading, forex trading, trading platform, divergence trading and more.

Tip #1 – Combining RSI Divergence with the Triangle Pattern

Two different versions of the triangle chart pattern are accessible. The pattern of the ascending triangle can be used to reverse a downtrend. The second variation is the descending circle pattern, which is reverse pattern when the market is in an upward direction. Take an examination of the descending triangle pattern in the chart below for forex. Similar to the example previously mentioned it started out in an uptrend before the price fell. RSI, however, also signifies the divergence. These indicators indicate the weakness of this trend. We can see that the uptrend is slowing down. The price formed an descending triangle due to this. This is a confirmation of the reversal. It's now time to take action on the trade. The techniques for breakout used in this trade were exactly the identical to the ones used in the previous example. We'll now move on to the third entry method. We'll try to pair trend structure with RSI divergence. Let's look at how we can trade RSI diversion when the trend structure is changing. Take a look at top rated rsi divergence cheat sheet for site recommendations including forex backtesting software free, automated trading, crypto trading backtester, automated trading, bot for crypto trading, trading platform cryptocurrency, RSI divergence cheat sheet, forex backtester, backtesting trading strategies, online trading platform and more.

Tip #2 – Combining RSI divergence and the Head & Shoulders Pattern

RSI divergence helps forex traders in recognizing market reverses. It can help make your trade more likely by combing RSI diversification with another factors that can reverse the market, such as the Head-and-shoulders pattern. Let's now look at how we can predict trades by combining RSI diversence with the Head-and-Shoulders pattern. Related: Trading Head and Shoulders Patterns in Forex: A Reversal Trading Method. A favorable market environment is necessary before we look at trade entry. A trending market is preferable as we are trying to find an opportunity to reverse the trend. Check out the chart below. View the best backtesting strategies for more examples including divergence trading, forex backtest software, backtesting trading strategies, best forex trading platform, automated trading bot, backtesting, divergence trading, best trading platform, best forex trading platform, backtesting and more.

Tip #3 – Combining RSI divergence and the trend structure

Trends are our partner. Trades should be made in line with the trend for as long as the market is moving in the right direction. Professionals will teach us. The trend does not continue for a long time. It will eventually change. Find out how to identify reversals fast by studying the structure of the trend as well as the RSI divergence. We all know that uptrend is forming higher high while the downtrend is forming lower lows. The chart below illustrates this point. If you look to the left side of this chart, you can observe that it's an uptrend, with a sequence of lows and lower highs. Take a closer look at the RSI divergence marked in the chart (Red Line). Price action is the cause of Lows, but the RSI makes higher lows is that right? What's the meaning of this? While the market is creating low RSI it's doing the exact opposite. This indicates that a downward trend might be losing momentum. Read the recommended automated crypto trading for website info including forex backtesting, trading platform, crypto trading bot, RSI divergence, forex tester, automated trading, backtester, automated crypto trading, crypto trading backtester, backtesting and more.

Tip #4 – Combining Rsi Divergence, The Double Top Double Bottom, And Double Bottom

A double top, also known as a double bottom, is a reversal trend that forms after an extended move. Double tops occur when the price reaches an amount that is unbreakable. broken. The price will then retrace slightly, but then return to the level it was at. DOUBLE TOPs happen in the event that the price bounces off the level. Have a look at the double top. This double top demonstrates that two tops were created following a shrewd move. The second top was unable to break above its predecessor. This is a sign of a reversal. It's telling buyers that they struggle to keep going higher. Double bottoms also employ the same techniques, however it is performed in an opposite direction. We utilize the technique of entering trades using breakouts. This means that we sell the trade when the trigger line crosses beneath the price. The price then hit our take profit in one day. QUICK PROFIT. The same trading techniques are applied for the double bottom as well. Check out the chart below to learn what you can do to trade RSI divergence in the event of the double bottom.

It's not the best trading strategy. There isn't a "perfect" trading strategy. Every strategy for trading is prone to losses. While we earn consistent profit through this strategy for trading but, we do have a strict risk management system and a method to reduce our losses. We can reduce our drawdown and open up opportunities for great upside potential.